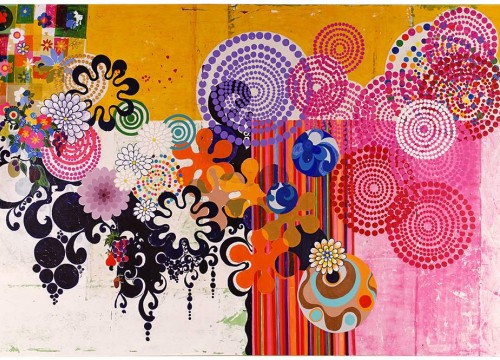

The dizzying and unexpected exploit of the NFTs

Cryptoart: plagiarism or revolution? Not even Gauguin would have been able to answer this question. Certainly we can no longer ignore a phenomenon that is upsetting the art market as we know it. We have new questions emerging every day.

Is painting dead? Will the market be dominated by digital art in the not too distant future? What will happen to art collectors?

Reasoning over the most recent developments, we realize that the exploit of cryptoart has been frenetic and, for many, unexpected. In 2018, the first artwork made with algorithms was sold for $432,000, and in that year, the total NFT market amounted to $41 million. In 2020, well before the NFT mania broke out, the market had risen to $338 million. In February 2021, the Nyan Cat sold for over half a million dollars. In March, a Banksy work was burned on a youtube livestream and its digital version got sold at four times the price of the incinerated one. During the same month, in addition to the NFT of the first tweet of the founder of Twitter which sold for about 2.5 million dollars, the record-breaking Beeple was sold for almost 70 million dollars at Christie’s.

To date, Mike Winkelmann (aka Beeple) is the third highest-rated living artist in the world hafter David Hockney and Jeff Koons. This digital fever has also reached the most established artists such as Damien Hirst, Urs Fischer and Ai Weiwei who, more out of fame than money, are fleeing to the various platforms. Most of the art galleries do not seem to be in favor of this new sales method and some of them are absolutely against it, for example Larry Gagosian who has terminated his contract with Urs Fischer following his arrival on Fair Warning and the subsequent sale of one of his works for 97,000 dollars.

A system immune to scam and hacking attempts has reached staggering numbers. Mike Winkelmann (aka Beeple) is the third highestrated living artist in the world after David Hockney and Jeff Koons

Other galleries proved to be more receptive, such as Pace Gallery, which in fact jumped at the chance of adding the aforementioned Fischer to its team. The boomerang effect, which in these situations is always just around the corner, has come to light. I am referring to the devastating energy and environmental impact of the NFTs that has been recently made public by British artist Memo Akten.

A single transaction on Ethereum requires the same amount of electricity that an average European citizen consumes in 4 days. NFT, Blockchain, Ethereum and Token will be our little pets that we will have to feed, grow and cuddle but they will have the advantage of not needing any care, because, at least theoretically, this system is immune to any attempt at fraud or hacking: a solid starting point for all those beginners who are jumping into the digital world without a parachute.